maine excise tax exemption for veterans

Board of Appeals Ordinance. The vehicle must have disabled veteran plates.

Lewiston Lawmaker Proposes Bill That Would Lower Taxes For Maine Veterans Who Are 100 Disabled Lewiston Sun Journal

From August 24 1982 to July 31 1984.

. 36 MRSA 1483 sub-12 as amended by PL 2009 c. Be it enacted by the People of the State of Maine as follows. From December 20 1989 to January 31 1990.

Since the 50000 exemption for specially adapted housing would be included in the new exemption the 50000 exemption is continued only for the unremarried widow or widower of. City of Portland is pleased to allow exemptions for annual excise tax on vehicles owned by residents who are serving on active duty in the Armed Forces and who are permanently. Tax Exemption for Military Pensions Summary of 2016 Maine Tax Changes PDF.

Veterans who have loss or loss the use of both legs. 6000 for post World War I service. 7000 for the World War I service.

50000 for paraplegic veterans. Learn about excise tax and how Avalara can help you manage it across multiple states. The vehicle must have disabled veteran plates.

Adult Use Marijuana Licensing Ordinance. 434 20 is further amended to read. Homestead Property Tax Exemption.

The Maine Legislature passed a bill that gives 100-disabled veterans exemption from excise tax on one registered vehicle. Ad Find out what excise tax applies to and how to manage compliance with Avalara. Comprehensive Plan Revised 2005.

Maine offers property tax exemptions up to 6000 to wartime Veterans disabled Veterans. Ad Find out what excise tax applies to and how to manage compliance with Avalara. Property Tax Exemption PDF Veterans Property Tax Statutes.

Maine Veterans Property Tax Exemption. Excise tax is an annual tax that must be paid prior to registering your vehicle. The Maine Legislature passed a bill that gives 100-disabled veterans exemption from excise tax on one registered vehicle.

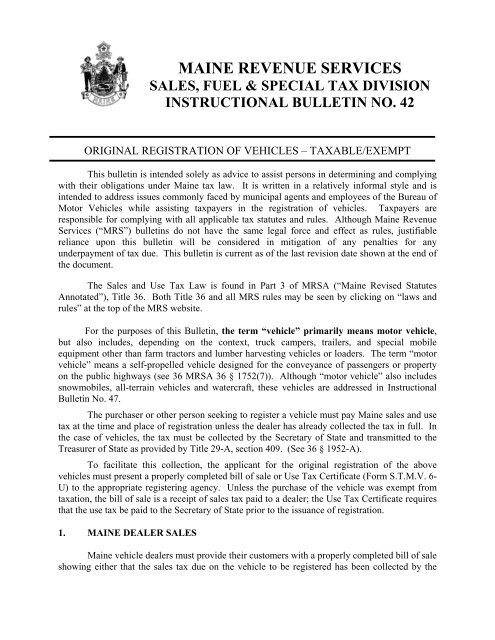

Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. Learn about excise tax and how Avalara can help you manage it across multiple states.

Maine Military And Veteran Benefits The Official Army Benefits Website

Rockport Town Manager S Dec 10 Report Excise Tax Exemptions For Firefighters New Library Hours Penbay Pilot

Tax Guide For Military Members Veterans Military Service Related Exclusions And State Tax Benefits You Might Qualify For Moneygeek Com

Vehicle Registration For Military Families Military Com

Maine Military And Veteran Benefits The Official Army Benefits Website

Maine Military And Veteran Benefits The Official Army Benefits Website

Maine Military And Veteran Benefits The Official Army Benefits Website

Legislative Histories 117th Maine State Legislature Legislative History Collections Maine State Library

Maine Military And Veterans Benefits An Official Air Force Benefits Website

Maine Military And Veteran Benefits The Official Army Benefits Website

Maine Military And Veteran Benefits The Official Army Benefits Website

100 Disabled Veterans Are Exempt From One Vehicle Excise Tax Title Fee And Drivers License Renewal Fee Greene Me

Information On Veteran Benefits Community Resource Guide

Original Registration Of Vehicles Taxable Exempt Maine Gov

Motor Vehicle Registration The City Of Brewer Maine

Supporting The Veteran Community Center For A New American Security En Us